Hilde Jenssen, Head of Fundamental Equities at Nordea Asset Management

Where do plastics come from?

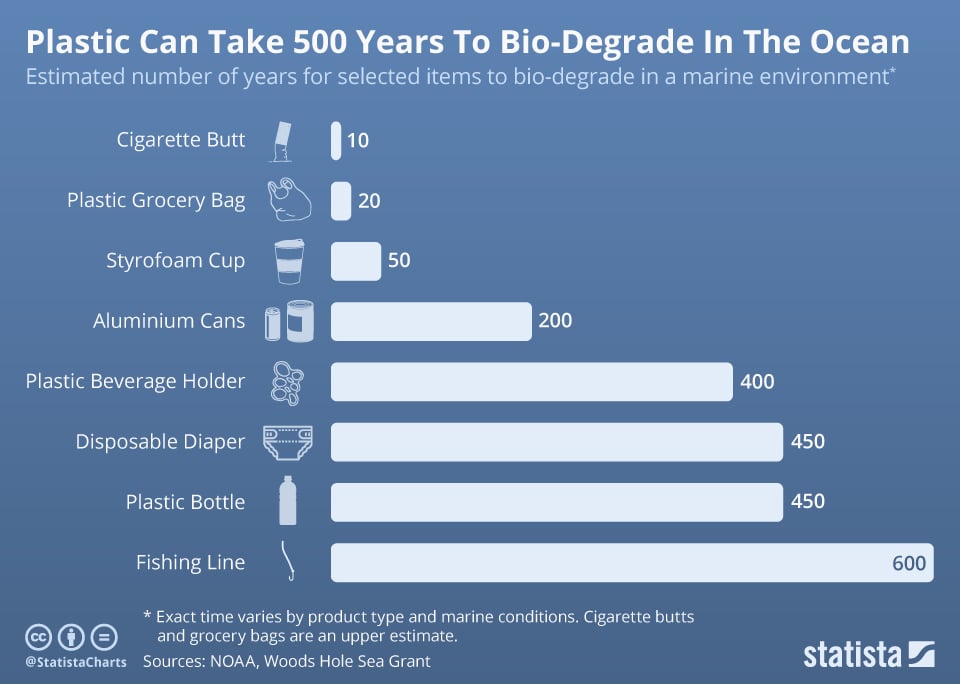

Before plastics become the ubiquitous cutlery, containers and bottle caps we use in everyday life, they originate with organic materials that are fossil fuel based or bio based—both are recyclable. The primary sources of man-made plastics are crude oil and natural gas. The life cycles of different types of plastics vary greatly

Source: Statista.com

Reduction

In 2017, China announced on January 1 that it no longer wanted to serve as the world’s waste receptacle. Since 1992, China has absorbed an estimated 45% of the world’s plastic waste. That year, Europe shipped 85% of its total waste to China. A whopping 110 mil metric tonnes of waste will have to be diverted by 2030 as a result of China’s move, putting pressure on other nations to step up, especially in Asia. Big plastic waste reduction programs represent an investment opportunity. Companies like Republic Services that deliver transfer stations and wase disposal solutions are positioned to benefit from this need.

Recycling

China’s unprecedented ban on plastic waste shipments was a wakeup call for the EU, which stated its own target that all plastic packaging should be recyclable or reusable by 2030. As of 2018, the recycling rate of plastic packaging waste was 41.2% in Europe.5

The EU recycling mandate creates opportunities for companies with the technical expertise in decomposing complex sets of materials. In our view, chemical companies may have this edge, especially if they are able to limit the environmental impact. Other beneficiaries are consumer goods companies via smart packaging design and cheaper recycled materials. Companies like Mondelez International that produce biodegradable packaging stand to benefit from a shift away from plastics.

Regulating

Recycling plastics is a megatrend which is likely to endure for many years to come. While companies grapple with investments, execution and transparency around their recycling programs, regulations are likely to become more stringent. To be sure, this megatrend will produce winners and losers, separating those companies that have a sustainable business strategy from those who do not. As active investors, it is our job to invest in companies that understand the difference. For example, Tomra Systems has developed a sensor-based sorting system that enables customers to extract higher-purity fractions from recycling and waste streams, in order to maximize both yields and profits. This system would greatly benefit companies that have to demonstrate their sustainability initiatives.

Reimagining

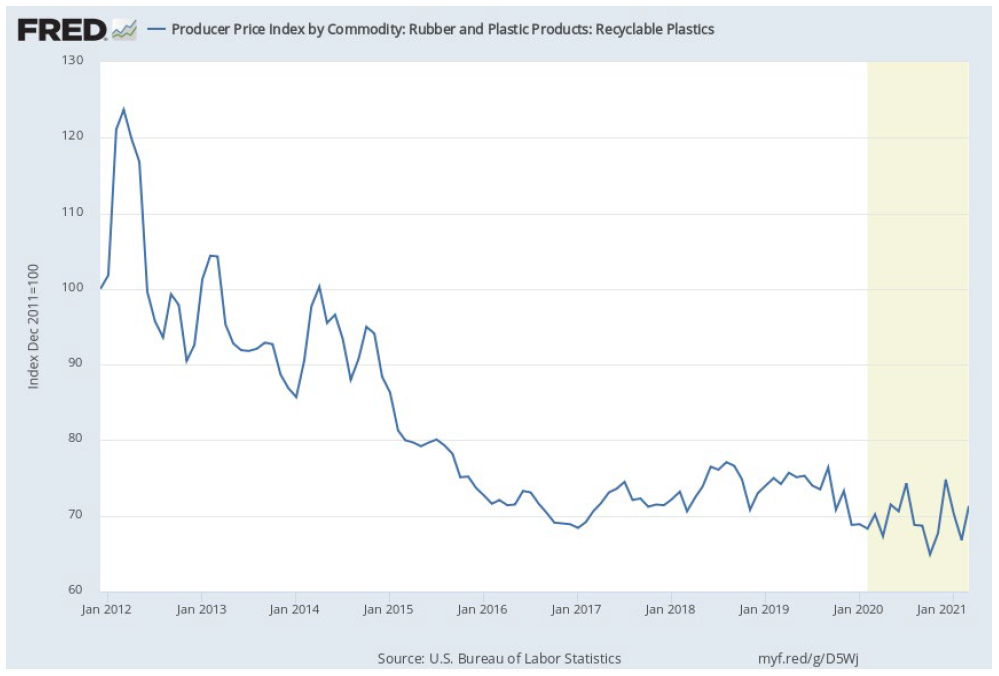

Consumer preferences are an important part of this equation, and the recent trends toward smaller sized pack-aging have created a headwind. On the positive side are lower input costs through lower recycled plastic prices, which have been trending down since 2011:

Source: Fred Economic Data

There is also an increasing trend toward repurposed plastic use. For example, Coca-Cola European Partners (CCEP) announced the introduction of WestRock’s CanCollar® Eco, an innovative paperboard packaging solution, for multipack cans in Spain. The move supports its work, in partnership with Coca-Cola in Western Europe, to remove all unnecessary or hard to recycle plastic from its portfolio, avoiding the use of more than 11,000 tons of virgin plastic a year across the region.

Investors take notice

As governments are taking aim at reducing pollution, there is mounting pressure on the private sector to take action. Many investors are demanding that companies improve their recycling practices and disclose their multi-year waste reduction goals. There is also a need to understand how a company’s earnings potential is affected and how waste reduction is tied to key personnel KPIs. This is particularly important for some consumer companies, which are among the world’s largest producers of plastic packaging materials.

Investors increasingly want to know, how will I make an environmental impact by investing in a company?

There are two ways investors can help to reduce plastic pollution:

- Invest in companies with clear recycling targets

- Invest in companies that provide alternatives to plastics, e.g. Renewable packaging firms.

Considering about 50% of all plastics are currently single-use, enforcing recycling rates will have a meaningful impact on the environment.

For investors, understanding the potential environmental impact of their investments is increasingly important. The health of the planet depends upon imaginative thinking in order to halt the vast tide of plastic waste. Thankfully, more and more companies are harnessing their power to address the problem through reduction, recycling and reimagining plastic usage.

Entrepreneurs often lead the way in combatting the planet´s challenges, and investors can make a support them in developing new technology and rethinking business models that positively contribute to both profit margins and social impact.

10 single-use plastics & their eco-friendly alternatives

| Plastic straws | Paper straws |

| Plastic drink stirrers | Bamboo stirs |

| Balloon Sticks | Paper lanterns |

| Plastic cutlery | Reusable or bamboo utensils |

| Plastic takeaway containers | Paper takeaway containers |

| Plastic water bottles | Reusable thermoses |

| Plastic plates | Porcelain or bamboo plates |

| Coffee cups & lids | Reusable cups and lids |

| Plastic bags | Reusable cloth bags |

| Plastic packaging | Paper packaging |